What we offer

We help people in north east Essex face incurable illness and bereavement, supporting them, their families, friends and carers.

Find out moreFor patients and families

St Helena offers support at the Hospice in Colchester and in patients own homes via our Hospice in the Home, SinglePoint and Virtual Ward services.

Find out moreBereavement support

St Helena helps adults, children & young people who have been bereaved. Our grief counselling is available for anyone, not just those with a hospice connection.

Find out moreHow you can help us

A third of our funding comes from the NHS, the remaining two thirds is raised from the generosity and support of people like you.

Find out moreDonate

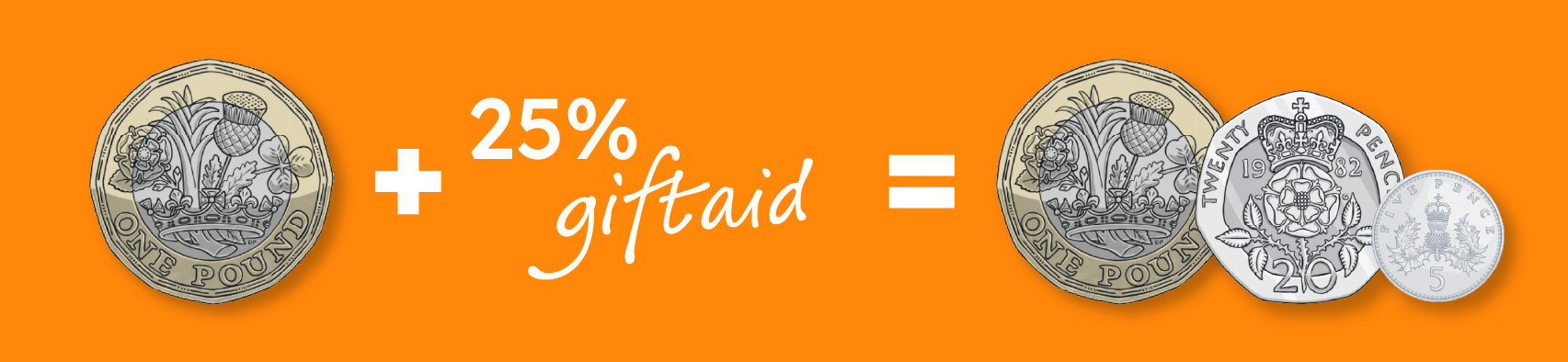

Your donation will help people in north east Essex facing incurable illness & bereavement.

Find out moreDonate in memory

Donate to charity in memory of your loved one. Every donation helps people in north east Essex face incurable illness & bereavement.

Find out moreFundraise

Fundraise your way as an individual, as a group, at school or at work and raise vital funds to help ensure more local people have dignity and choice at the end of life.

Find out moreLeave a gift in your Will

Leaving a gift in your Will to St Helena Hospice can leave a lasting legacy.

Find out moreCorporate support and partnerships

Find out more about how your business can support St Helena Hospice through corporate partnership, support and fundraising.

Find out more